Best Practice Case: Alibaba.com

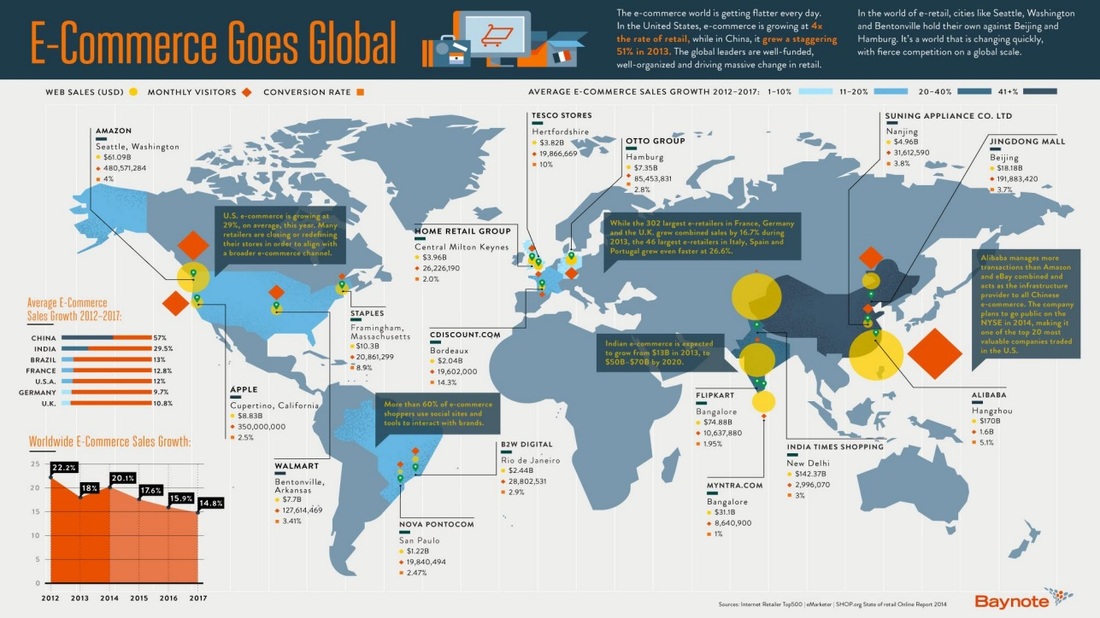

Electronic delivery of goods and services has become a megatrend since the booming of IT. E-commerce, to be more specific is the way businesses are using to deliver goods and services to customers.

Alibaba has achieved enormous success with its e-commerce business. Understand, take advantage and lead the mega impact of this megatrend, Alibaba has grown and expanded vastly during a short period of time.

Alibaba has achieved enormous success with its e-commerce business. Understand, take advantage and lead the mega impact of this megatrend, Alibaba has grown and expanded vastly during a short period of time.

EXECUTIVE MEMO

1. Business Summary

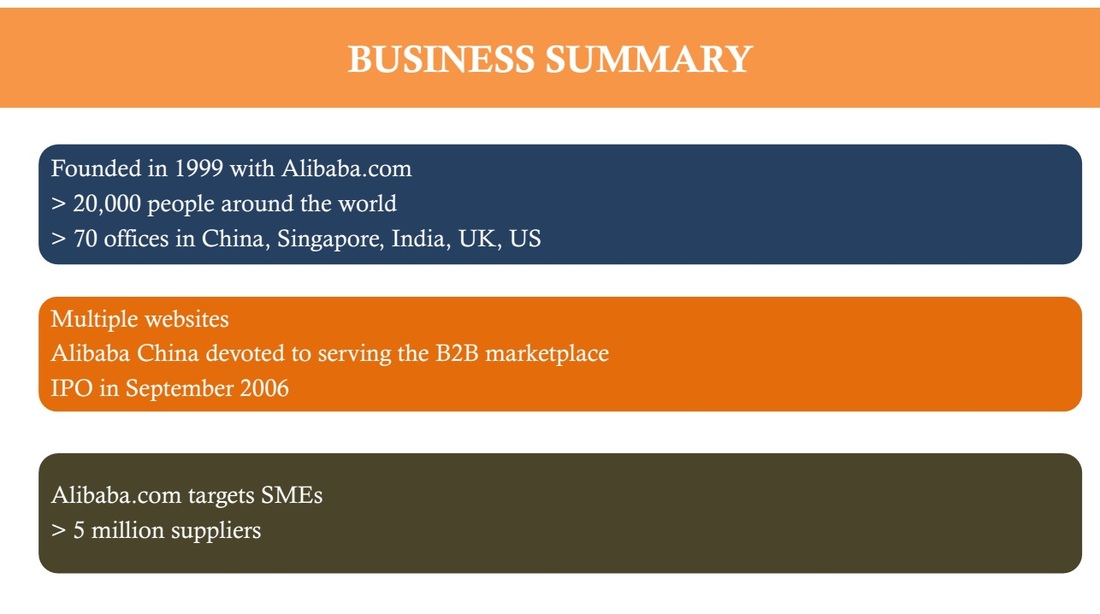

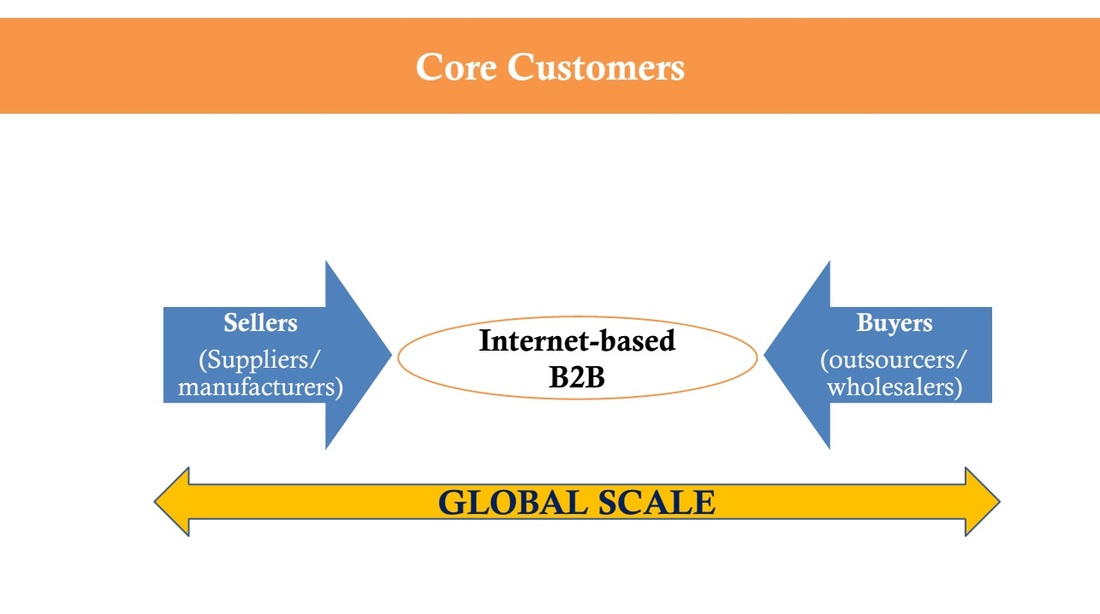

Alibaba.com is the flagship company of Alibaba Group which was founded in 1999 in China, being the world’s largest online business-to-business trading platform for small-and-medium size businesses (SMEs).

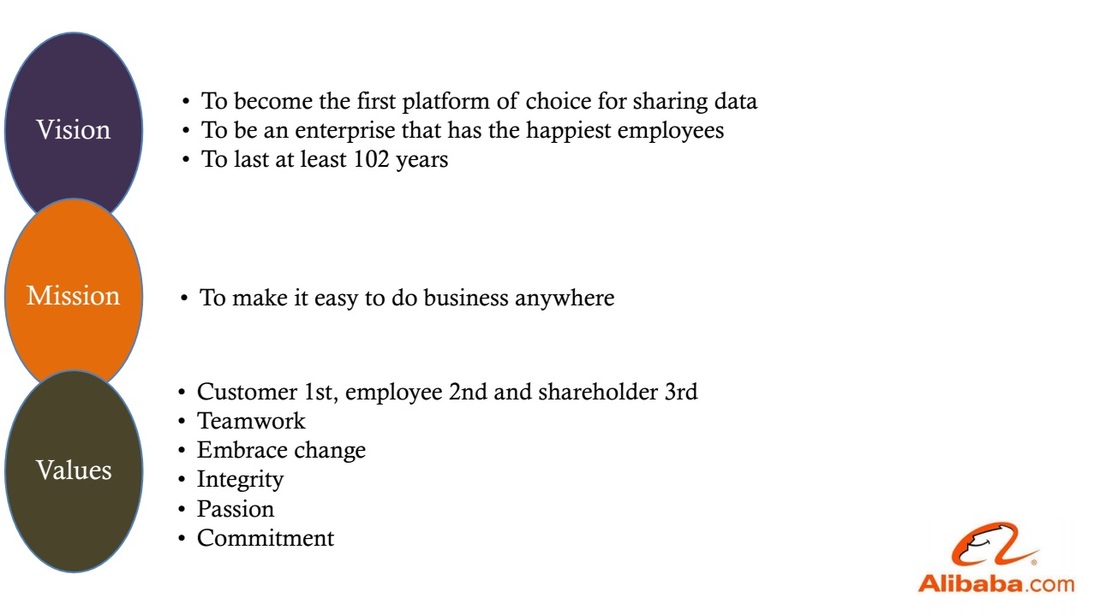

Key values of Alibaba are (1) Customer 1st, employee 2nd and shareholder 3rd; (2) Teamwork; (3) Embrace change; (4) Integrity; (5) Passion; (6) Commitment.

Alibaba has 7 subsidiary companies, which are involved in the business of B2B, C2C, online payments, software service, search engine, online advertising, local living, and consumption community, etc.

2. SWOT

- Strength: Reputation of success and effective growth strategies

- Weakness: Low degree of business e-commerce search technology& low brand recognition

- Opportunity: Large untapped market potential & market share possibility in the US

- Threat: Growth of China’s ecommerce industry & influence by competitors

3. Strategic Issues

Strategic issues of Alibaba is considered on the basis of its SWOT analysis and the cross combination of its component factors, leading to 3 questions: (1) How will Alibaba will compete when facing changes in the environment? (2) How will Alibaba stand strong with their vision of 102 years? and (3) How will they explore its “blue oceans”?

4. Strategic Solutions

- Grasping market share in the US by way of acquisition of a US recognized company (SO Strategy).

- Acquire a small technology company (WO Strategy).

- Bolster differentiation (ST Strategy)

- Develop a real commitment to marketing on a global scale (WT Strategy).

5. Reasoning

Alibaba is believed to deal with its weakness of low technology through acquiring a small technology company. It, technically, would move Alibaba into a more competitive place and offer an opportunity for growth in addition. Acquisition is also regarded as an effective way to further expand its market share with a close eye on the US. Capital addition in need is estimated hovering around 635 million USD, part of which is specifically intended for marketing campaign in 10 years to come.

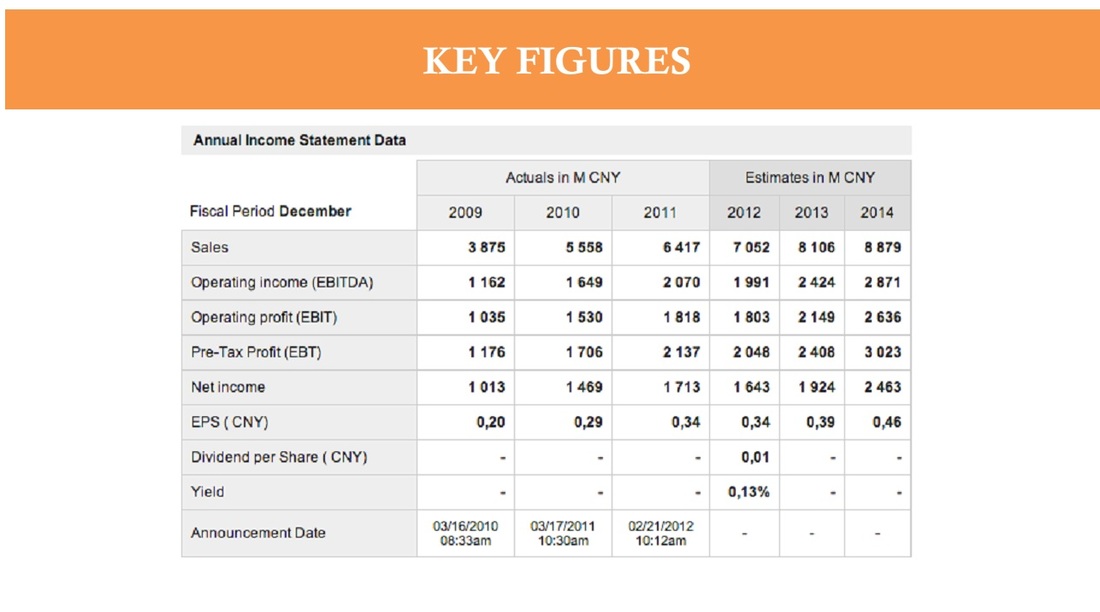

Financial projections suggest that in a decade, with sufficient financial resources, Alibaba will be ready to generate a total net income of 1.8 billion USD for the period 2014 through 2019 and 2.4 billion USD in 5 years from 2020 to 2025, indicating an average growth of some 19.6% per year. As a meaningful result, EPS would jump from 432 USD to 541 USD over the two time-spans concerned.

Dividend paid-out is projected to gain an annual increase 21.2% by end of 2019 and enjoy a more significant upward trend up to 23.07% for each of the 5 years from 2020 onwards.

A good marketing strategy can be a real turning point for a company and dramatically improve the bottom-line. Marketing expense, set to roughly double in average, is intended for seconding differentiation practice, which may end up fostering Alibaba brand image on a global scale and introducing approximately 20% annual growth in revenue

1. Business Summary

Alibaba.com is the flagship company of Alibaba Group which was founded in 1999 in China, being the world’s largest online business-to-business trading platform for small-and-medium size businesses (SMEs).

Key values of Alibaba are (1) Customer 1st, employee 2nd and shareholder 3rd; (2) Teamwork; (3) Embrace change; (4) Integrity; (5) Passion; (6) Commitment.

Alibaba has 7 subsidiary companies, which are involved in the business of B2B, C2C, online payments, software service, search engine, online advertising, local living, and consumption community, etc.

2. SWOT

- Strength: Reputation of success and effective growth strategies

- Weakness: Low degree of business e-commerce search technology& low brand recognition

- Opportunity: Large untapped market potential & market share possibility in the US

- Threat: Growth of China’s ecommerce industry & influence by competitors

3. Strategic Issues

Strategic issues of Alibaba is considered on the basis of its SWOT analysis and the cross combination of its component factors, leading to 3 questions: (1) How will Alibaba will compete when facing changes in the environment? (2) How will Alibaba stand strong with their vision of 102 years? and (3) How will they explore its “blue oceans”?

4. Strategic Solutions

- Grasping market share in the US by way of acquisition of a US recognized company (SO Strategy).

- Acquire a small technology company (WO Strategy).

- Bolster differentiation (ST Strategy)

- Develop a real commitment to marketing on a global scale (WT Strategy).

5. Reasoning

Alibaba is believed to deal with its weakness of low technology through acquiring a small technology company. It, technically, would move Alibaba into a more competitive place and offer an opportunity for growth in addition. Acquisition is also regarded as an effective way to further expand its market share with a close eye on the US. Capital addition in need is estimated hovering around 635 million USD, part of which is specifically intended for marketing campaign in 10 years to come.

Financial projections suggest that in a decade, with sufficient financial resources, Alibaba will be ready to generate a total net income of 1.8 billion USD for the period 2014 through 2019 and 2.4 billion USD in 5 years from 2020 to 2025, indicating an average growth of some 19.6% per year. As a meaningful result, EPS would jump from 432 USD to 541 USD over the two time-spans concerned.

Dividend paid-out is projected to gain an annual increase 21.2% by end of 2019 and enjoy a more significant upward trend up to 23.07% for each of the 5 years from 2020 onwards.

A good marketing strategy can be a real turning point for a company and dramatically improve the bottom-line. Marketing expense, set to roughly double in average, is intended for seconding differentiation practice, which may end up fostering Alibaba brand image on a global scale and introducing approximately 20% annual growth in revenue